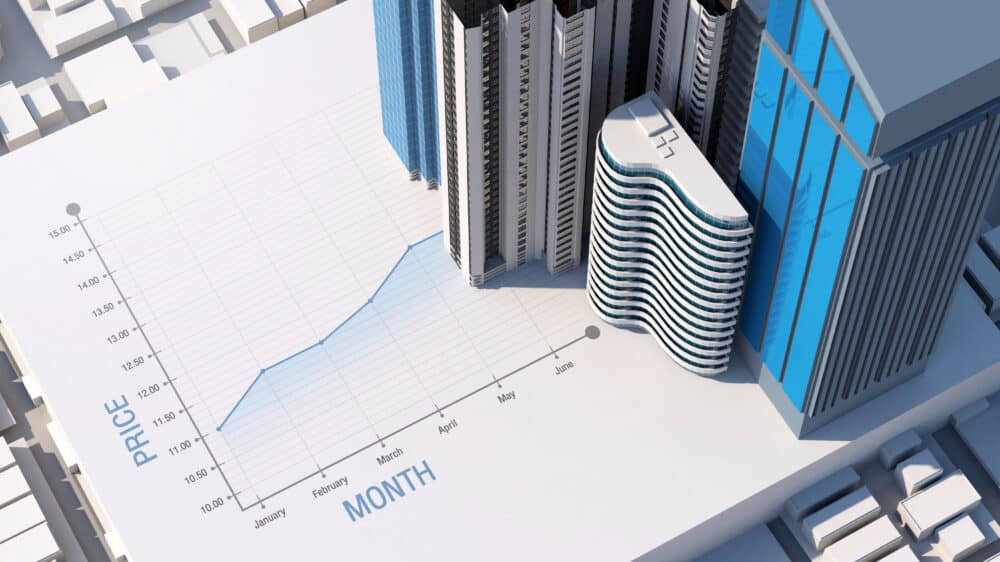

The latest announcement from Bank of England, published at 12pm, announce an increase of 0.25% to 4.5%. This decision has been made as pressures increase on mortgage payers and businesses, who are fighting against inflationary increases and struggling to pay off loans. This is the 12th consecutive rise in interest rates and continues to push past the last peak following the 2008 financial crisis and the highest level for nearly 15 years.

“The government’s fiscal policy continues to be largely dictated by the Bank of England and their goal of cooling market activity. This will be a blow not just to those looking to re-mortgage and struggling first-time buyers, but also to the commercial real estate sector, where the escalating cost of debt is starting to have massive implications on site viability. Coupled with rising costs of goods and fuel, and a struggling labour market in construction, it’s becoming clear that this may continue for longer than some either predicted or hoped, as the inflation fire continues to burn. “The effect on transaction volumes will be evident in the months that follow. Property lawyers may feel more pressure to compete for business, in which digital excellence as a competitive advantage will ensure greater transaction resilience, speed and efficiency. Until the industry adopts wholesale digital reform however, economic headwinds will continue to test market resilience with greater impact, from protracted transaction lengths to higher fall-throughs.”

Andy Sommerville

Andy Sommerville